Types Of Investments

Stocks

Stocks, Also Known As Shares Or Equities, Represent Ownership In A Company. When You Buy A Stock, You Buy A Small Part Of That Company. Companies Issue Stock To Raise Money For Various Purposes, Such As Expanding Their Business, Launching New Products Or Paying Off Debt.

Here Are Key Points To Understand About Stocks:

Ownership And Dividends

Ownership: Owning Stock Means You Own A Portion Of The Company. The Number Of Shares You Own Relative To The Company’s Total Shares Determines Your Percentage Of Ownership.

Dividends: Some Companies Pay Dividends, Which Are Part Of Their Profits Distributed To Shareholders. Not All Stocks Pay Dividends; Some Companies Invest The Profits Back Into The Business.

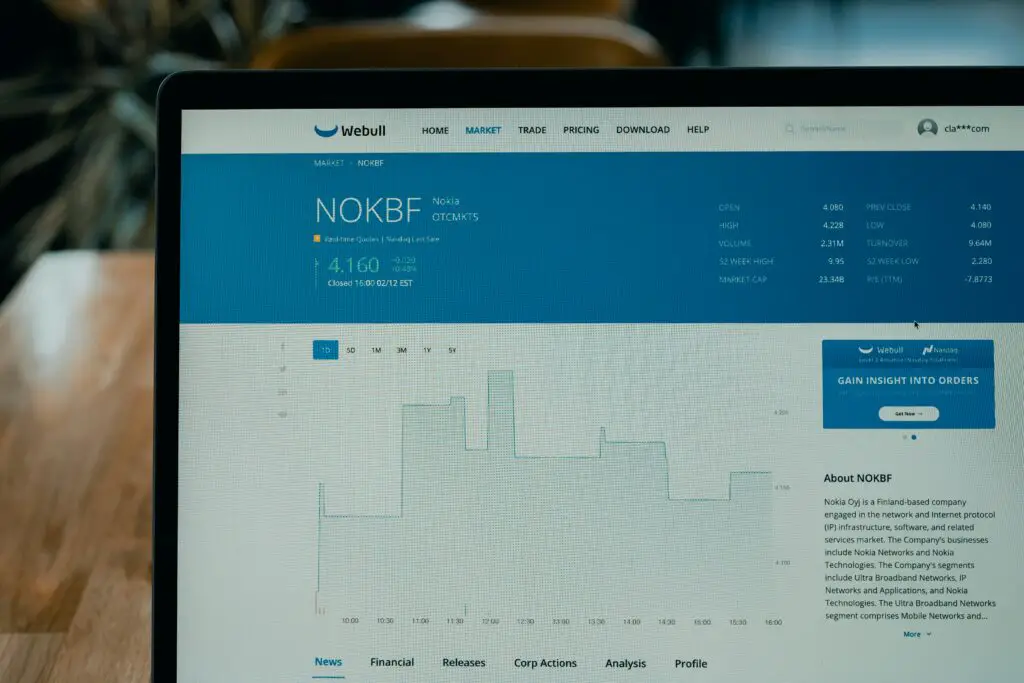

Stock Markets

Stock Exchanges: Stocks Are Traded On Stock Exchanges Such As The New York Stock Exchange (Nyse) And The Nasdaq. These Exchanges Provide A Platform For Buying And Selling Stocks.

Ticker Symbol: Each Stock Is Identified By A Unique Ticker Symbol, Such As Aapl For Apple Inc. Or Msft For Microsoft Corporation.

Price And Valuation

Stock Price: The Price Of A Stock Fluctuates Based On Supply And Demand, Influenced By Company Performance, Economic Conditions, And Investor Sentiment.

Market Capitalization: The Total Market Value Of A Company’s Outstanding Shares, Calculated By Multiplying The Stock Price By The Total Number Of Shares.

Types Of Stock

Common Stock: These Stocks Give Shareholders Voting Rights And The Potential For Dividends. Common Shareholders Are Last In Line To Receive Assets In The Event Of A Company Liquidation.

Preferred Stock: These Stocks Typically Do Not Offer Voting Rights, But They Have A Higher Claim On Assets And Earnings. Preferred Shareholders Often Receive Dividends Before Common Shareholders.

Investing In Stocks

Capital Gains: Investors Can Make Money From Stocks Through Capital Gains, Which Occur When They Sell A Stock For More Than What They Paid For It.

Risk: Stock Investing Can Be Risky. Stock Prices Can Be Volatile, And There Is The Potential To Lose The Money Invested If The Company Performs Poorly.

Diversification And Strategy

Diversification: Spreading Investments Across Different Stocks Or Sectors To Reduce Risk.

Investment Strategies: Strategies Vary From Long-Term Investing (Buying And Holding Stocks For Years) To Short-Term Trading (Buying And Selling Quickly To Take Advantage Of Price Fluctuations).

Understanding Stocks And How They Work Is Important For Anyone Interested In Investing In The Stock Market. They Offer The Potential For Significant Returns, But It Is Essential To Know About The Risks Associated With Them And Do Thorough Research Before Investing.

Bonds

A Bond Is A Type Of Investment That Represents A Loan Made By An Investor To A Borrower, Typically A Corporation Or Government. Here Is An Overview Of How Bonds Work And The Different Types Of Bonds Available:

How Bonds Work

Issuer: The Entity That Borrows Money By Issuing A Bond. It Can Be A Government, Municipality, Corporation, Or Other Entity.

Principal: The Amount Borrowed, Which The Issuer Agrees To Pay Back To The Bondholder On The Bond’s Maturity Date.

Coupon: The Interest Payment Made To The Bondholder, Which Is Typically Paid Semi-Annually Or Annually. It Is Usually A Fixed Percentage Of The Bond’s Face Value.

Maturity Date: The Date On Which The Bond’s Principal Is Repaid To The Bondholder.

Types Of Bonds

Government Bonds

Treasury Bonds: Are Issued By National Governments And Are Considered Very Safe. Examples Include The U.S. Treasury.

Municipal Bonds: Are Issued By State Or Local Governments. The Interest Earned Is Often Exempt From Federal And Sometimes State Taxes.

Sovereign Bonds: Issued By Foreign Governments. The Risk Varies Depending On The Stability Of The Issuing Country.

Corporate Bonds

Are Issued By Companies To Raise Capital. Generally, They Offer Higher Yields Than Government Bonds, But Come With More Risk.

Investment-Grade Bonds: Issued By Companies With Strong Credit Ratings.

High-Yield (Junk) Bonds: Issued By Companies With Low Credit Ratings, Offering Higher Returns To Compensate For The Higher Risk.

Agency Bonds

Are Issued By Government-Linked Organizations. They Often Offer Slightly Higher Yields Than Treasury Bonds, But With The Same Low-Risk Characteristics.

Zero-Coupon Bonds

Are Sold At A Discount To Their Face Value And Do Not Pay Periodic Interest. Instead, The Bondholder Receives The Face Value At Maturity.

Convertible Bonds

Corporate Bonds That Can Be Converted Into A Predetermined Number Of Shares Of The Issuer. These Offer The Potential For Appreciation If The Company’s Stock Price Rises.

Inflation-Linked Bonds

Principal And Interest Payments Are Adjusted For Inflation. Examples Include U.S. Treasury Inflation-Protected Securities (Tips).

Benefits Of Investing In Bonds

Stability: Bonds Are Generally Less Volatile Than Stocks.

Income: Regular Interest Payments Provide A Steady Income Stream.

Diversification: Including Bonds In A Portfolio Can Reduce Overall Risk.

Tax Benefits: Some Bonds, Such As Municipal Bonds, Provide Tax-Free Interest Income.

Risks Of Investing In Bonds

Interest Rate Risk: Bond Prices Fall When Interest Rates Rise.

Credit Risk: The Issuer May Default On Interest Or Principal Payments.

Inflation Risk: Inflation Can Reduce The Purchasing Power Of Interest Payments.

Liquidity Risk: Some Bonds May Be Difficult To Sell Quickly Without Taking A Loss.

Bonds Play An Important Role In A Diversified Investment Portfolio, Offering A Balance Of Risk And Return, And Providing A Reliable Income Stream.

Mutual Funds

A Mutual Fund Is A Popular Type Of Investment That Pools Money From Many Investors To Buy A Diversified Portfolio Of Securities. Here’s An Overview Of Mutual Funds And The Different Types Available:

What Is A Mutual Fund?

A Mutual Fund Is An Investment Vehicle That Pools Money From Many Investors To Invest In A Diversified Portfolio Of Stocks, Bonds Or Other Securities. Each Investor Owns Shares Of The Mutual Fund, Which Represent A Portion Of Its Holdings.

Key Features Of A Mutual Fund:

Professional Management: Managed By Professional Fund Managers Who Make Investment Decisions On Behalf Of Investors.

Diversification: Investments Are Spread Across Different Assets, Thereby Reducing Risk.

Liquidity: Mutual Fund Shares Can Be Bought Or Sold On Any Business Day.

Affordability: Allows Small Investors To Participate In A Diversified Portfolio.

Regulation: Subject To Regulation To Protect Investors.

Types Of Mutual Funds:

There Are Different Types Of Mutual Funds, Each Designed To Meet Different Investment Objectives:

Equity Funds: Invest Primarily In Stocks. They Are Suitable For Investors Seeking Capital Appreciation And Are Classified Into The Following Sub-Types:

Growth Funds: Focus On Companies That Are Expected To Grow At An Above-Average Rate.

Value Funds: Invest In Undervalued Companies That Are Expected To Provide Stable Returns.

Sector Funds: Focus On Specific Industries (E.G., Technology, Healthcare).

Fixed-Income Funds (Bond Funds): Invest In Bonds Or Other Debt Securities. They Aim To Provide Regular Income And Are Less Risky Than Equity Funds. Examples Include:

Government Bond Funds: Invest In Government Securities.

Corporate Bond Funds: Invest In Bonds Issued By Companies.

Municipal Bond Funds: Invest In Bonds Issued By Local Governments.

Money Market Funds: Invest In Short-Term, High-Quality Debt Instruments Such As Treasury Bills And Certificates Of Deposit. They Are Low Risk And Provide Liquidity With Modest Returns.

Balanced Funds (Hybrid Funds): Combine Stocks, Bonds, And Other Securities In A Single Portfolio. They Aim To Provide A Balance Of Income, Growth, And Risk Reduction.

Index Funds: Aim To Replicate The Performance Of A Particular Market Index (E.G., The S&P 500). These Have Lower Fees Than Actively Managed Funds.

Exchange-Traded Funds (Etfs): Similar To Index Funds But Trade On A Stock Exchange Like Individual Stocks. These Offer Flexibility And Lower Costs.

Target-Date Funds: Designed For Retirement Savings, These Funds Adjust Their Asset Allocation As The Target Date (E.G., Retirement Year) Approaches, Becoming More Conservative Over Time.

Specialty Funds: Focus On Particular Strategies Or Sectors, Such As:

Real Estate Funds: Invest In Real Estate Properties Or Real Estate Investment Trusts (Reits).

Commodity Funds: Invest In Physical Commodities, Such As Gold Or Oil.

International Funds: Invest In Securities From Foreign Markets.

Choosing The Right Mutual Fund:

When Choosing A Mutual Fund, Consider Factors Such As Investment Goals, Risk Tolerance, Time Horizon, Fees, And The Fund’s Performance History. It’s Also Important To Read The Fund’s Prospectus To Understand The Fund’s Objectives, Strategies, And Risks.

Exchange-Traded Funds (Etfs)

Exchange-Traded Funds (Etfs) In Investment Types

Exchange-Traded Funds (Etfs) Are A Type Of Investment Fund And Exchange-Traded Product, Meaning They Are Traded On Stock Exchanges. Etfs Hold Assets Such As Stocks, Commodities Or Bonds And Typically Operate With An Arbitrage Mechanism Designed To Keep The Price Trading As Close To Its Net Asset Value As Possible, Although Deviations Can Sometimes Occur. Here Is A Description Of The Key Aspects Of Etfs:

1. Structure And Management

Open-Ended Funds: Most Etfs Are Structured As Open-Ended Funds, Meaning They Can Issue And Redeem Shares At Any Time.

Passive Vs. Active Management: Etfs Can Be Passively Managed, Often Tracking An Index Such As The S&P 500, Or Actively Managed, Where Managers Make Decisions About Asset Allocation And Stock Selection To Outperform The Benchmark.

2. Types Of Etfs

Stock Etfs: These Etfs Track A Particular Index Of Stocks And May Cover Different Sectors, Regions Or Investment Styles. Examples Include The Spdr S&P 500 Etf (Spy) And The Ishares Msci Emerging Markets Etf (Eem).

Bond Etfs: Bond Etfs Focus On Bonds Or Other Debt Instruments. They May Track Specific Types Of Bonds, Such As Corporate, Municipal Or Government Bonds. Examples Include The Ishares Iboxx $ Investment Grade Corporate Bond Etf (Lqd).

Commodity Etfs: These Etfs Invest In Commodities Such As Gold, Oil Or Agricultural Products. Examples Include The Spdr Gold Shares (Gld) And The United States Oil Fund (Uso).

Sector And Industry Etfs: These Etfs Focus On Specific Sectors Or Industries, Such As Technology, Healthcare Or Energy. Examples Include The Technology Select Sector Spdr Fund (Xlk) And The Financial Select Sector Spdr Fund (Xlf).

International Etfs: These Etfs Provide Exposure To Markets Outside The Investor’s Home Country. Examples Include The Vanguard Ftse Europe Etf (Vgk) And The Ishares Msci Japan Etf (Ewj).

Thematic Etfs: These Etfs Target Specific Investment Themes, Such As Clean Energy, Artificial Intelligence Or Blockchain Technology. Examples Include The Global X Robotics And Artificial Intelligence Etf (Botz).

Inverse And Leveraged Etfs: Inverse Etfs Aim To Deliver The Inverse Performance Of A Particular Index, While Leveraged Etfs Aim To Deliver Multiples (E.G., 2x Or 3x) Of The Index’s Performance. Examples Include The Proshares Ultrapro S&P 500 (Upro) And The Proshares Short S&P 500 (Sh).

3. Benefits Of Etfs

Diversification: Etfs Allow Investors To Purchase A Broad Basket Of Assets, Providing Instant Diversification.

Liquidity: Etfs Are Traded On Exchanges, Which Provides Liquidity And The Ability To Buy And Sell Shares At Market Price Throughout The Business Day.

Low Costs: Etfs Generally Have Lower Expense Ratios Than Mutual Funds, Especially Passive Etfs.

Transparency: Etfs Generally Disclose Their Holdings Daily, Providing Transparency To Investors.

Tax Efficiency: Etfs Can Be More Tax-Efficient Than Mutual Funds Due To Their Unique Creation And Redemption Process.

4. Considerations And Risks

Market Risk: Like All Investments, Etfs Are Subject To Market Risk. The Value Of An Etf Can Go Up Or Down Depending On The Underlying Assets.

Tracking Error: Etfs May Not Perfectly Track Their Underlying Index Due To Various Factors Such As Fees, Expenses, And Imperfect Replication.

Liquidity Risk: Some Etfs May Have Low Trading Volume, Which Can Lead To Wider Bid-Ask Spreads And Potential Difficulties In Buying Or Selling Shares.

Counterparty Risk: Inverse And Leveraged Etfs Often Use Derivatives, Which Introduce Counterparty Risk.

Etfs Are Versatile Investment Tools Suitable For A Wide Range Of Investment Strategies And Goals. They Provide A Way To Gain Exposure To Different Asset Classes, Sectors, And Markets, Making Them An Essential Component Of The Modern Investment Portfolio.

Real Estate

Real Estate Is A Popular Form Of Investing That Involves The Purchase, Ownership, Management, Rental And/Or Sale Of Real Estate For Profit. It Can Be Classified Into Several Types, Each Of Which Has Its Own Characteristics, Benefits And Risks. Here Are The Main

Types Of Real Estate Investments:

1. Residential Real Estate

This Includes Properties That Are Used Primarily For Personal Living Purposes. It Includes:

Single-Family Homes: Stand-Alone Properties Designed For One Family.

Multi-Family Homes: Properties With Multiple Units (E.G., Duplexes, Triplexes, Apartment Buildings) That Are Designed To House Multiple Families.

Condos And Townhouses: Shared Property Units In A Larger Building Or Complex.

Vacation Homes: Properties Used For Short-Term Rentals Or Personal Vacation Purposes.

Benefits:

Steady Rental Income.

Appreciation In Property Value Over Time.

Tax Benefits Such As Deductions On Mortgage Interest And Property Taxes.

Risks:

Property Management And Maintenance Costs.

Market Instability Affecting Property Values.

Tenant Issues And The Potential For Vacancies.

2. Commercial Real Estate

This Includes Properties Used For Business Purposes. It Includes:

Office Buildings: Spaces Leased To Businesses For Office Use.

Retail Space: Properties Leased To Businesses For Retail Purposes (E.G., Shopping Centers, Malls, Storefronts).

Industrial Properties: Facilities Used For Manufacturing, Production, Storage, Or Distribution (E.G., Warehouses, Factories).

Mixed-Use Developments: Properties That Combine Residential, Commercial, And Sometimes Industrial Uses.

Advantages:

Higher Rental Income Than Residential Properties.

Long-Term Leases Providing Stable Cash Flow.

Diversity Across Different Types Of Commercial Tenants.

Risks:

Higher Initial Investment Costs.

Long Vacancies And Lease Negotiations.

Market Sensitivity To Economic Conditions And Business Cycles.

3. Industrial Real Estate

This Type Of Real Estate Is Used For Industrial Purposes Such As Manufacturing, Production, Storage, And Distribution. This Includes:

Warehouses: Large Storage Spaces For Goods And Materials.

Distribution Centers: Facilities Designed For The Rapid Movement Of Goods.

Manufacturing Plants: Properties Used For The Production Of Goods.

Flex Space: Combination Of Office And Industrial Use.

Benefits:

Stable And Long-Term Leases.

Low Maintenance Compared To Residential Properties.

Increasing Demand Due To E-Commerce Growth.

Risks:

High Initial Investment.

Sensitivity To Economic Changes.

Special Tenant Requirements.

4. Retail Real Estate

This Includes Properties Used For Retail Businesses. This Includes:

Shopping Centers And Malls: Large Complexes With Multiple Retail Stores.

Strip Malls: Small Retail Complexes With Multiple Stores.

Standalone Retail Stores: Individual Retail Properties.

Benefits:

Potential For High Rental Income.

Long-Term Lease Agreements.

Ability To Capitalize On Prime Locations.

Risks:

Dependence On The Success Of Retail Tenants.

The Market Is Moving Towards Online Shopping.

High Maintenance And Operating Costs.

5. Mixed-Use Development

These Properties Combine Residential, Commercial And Sometimes Industrial Uses In A Single Development. Examples Include:

Urban Development: Projects Combining Apartments, Offices, Retail Space And Public Amenities In City Centers.

Suburban Development: Mixed-Use Complexes In Suburban Areas.

Benefits:

Diversified Income Streams.

Increased Property Value Due To Multiple Uses.

Increased Foot Traffic Benefiting Commercial Tenants.

Risks:

Complex Management Due To Multiple Uses.

High Development And Operating Costs.

Zoning And Regulatory Challenges.

6. Reit (Real Estate Investment Trust)

These Are Companies That Own, Operate Or Finance Income-Producing Real Estate In Various Areas. Investors Can Buy Shares In Reits, Which Are Traded On Major Stock Exchanges.

Benefits:

Similar Liquidity To Stocks.

Diversification Across Different Real Estate Sectors.

Regular Income Through Dividends.

Risks:

Market Volatility Affecting Share Prices.

Dependence On Management Performance.

Exposure To Sector-Specific Risks.

7. Land

Investing In Raw, Undeveloped Land Or Land Scheduled For Development. This Can Include Agricultural Land, Timberland Or Plots For Future Construction.

Benefits:

Potential For Significant Appreciation.

Low Maintenance Costs.

Flexibility In Development Options.

Risks:

Not Immediately Income Generating.

Zoning And Regulatory Challenges.

Market Volatility Affecting Land Value.

Commodities

Commodities As A Type Of Investment Refer To Raw Materials Or Primary Agricultural Products That Can Be Bought And Sold. These Include Commodities Such As Gold, Oil, Natural Gas, Wheat And Coffee. Investing In Commodities Can Be Done In A Number Of Ways, Each Of Which Offers Different Risk Levels, Potential Returns And Investment Strategies. Here Is An Overview Of The Main Types Of Commodity Investments:

1. Physical Commodities

Direct Purchase: Investors Buy The Actual Commodity, Such As Gold Bars, Silver Coins Or Agricultural Products. This Requires Storage And Insurance, But Provides Tangible Ownership.

Advantages: Direct Ownership, Can Be A Hedge Against Inflation.

Disadvantages: Storage And Insurance Costs, Liquidity Can Be An Issue.

2. Commodity Futures

Futures Contracts: Agreements To Buy Or Sell A Specific Amount Of A Commodity At A Predetermined Price And Date In The Future. These Are Traded On Futures Exchanges.

Advantages: Potential For High Returns, Leverage Allows Large Positions With Relatively Small Investments.

Cons: High Risk Due To Leverage, Complex And Requires Expertise, Potential For Significant Losses.

3. Commodity Etfs (Exchange-Traded Funds)

Etfs: These Funds Track The Price Of A Commodity Or Basket Of Commodities And Trade On Stock Exchanges. They Provide A Way To Invest Without Owning The Physical Commodity Or Futures Contracts.

Pros: Easy To Trade, Low Costs, Diversification And Liquidity.

Pros: Management Fees, Tracking Errors.

4. Commodity Stocks

Stocks: Investing In Companies That Produce Or Are Related To Commodities, Such As Mining Companies, Oil And Gas Firms Or Agribusinesses.

Pros: Potential For Dividends, Low Direct Exposure To Commodity Price Volatility, Company Growth Potential.

Pros: Stock Market Risk, Company-Specific Risk.

5. Mutual Funds And Index Funds

Funds: These Invest In Commodity-Related Stocks Or A Diversified Portfolio Of Commodities.

Pros: Diversification, Professional Management, Easy For Individual Investors.

Cons: Management Fees, Potential For Lower Returns Than Direct Commodity Investments.

6. Commodity Pools And Managed Futures

Pools/Managed Futures: Investment Funds That Pool Money From Many Investors To Trade In Commodity Futures And Options.

Pros: Professional Management, Diversification, Potential For High Returns.

Cons: High Fees, Complex Investment Instrument, High Risk.

7. Commodity Options

Options Contracts: Provide The Right, But Not The Obligation, To Buy Or Sell A Commodity At A Specific Price Within A Certain Time Frame.

Pros: Limited Risk On The Premium Paid, Leverage.

Cons: Can Be Worthless, Are Complex, Require Expertise.

Benefits Of Investing In Commodities:

Diversification: Commodities Often Move Differently Than Stocks And Bonds, Providing Diversification To An Investment Portfolio.

Inflation Hedge: Commodity Value Increases During Inflationary Periods, Protecting Purchasing Power.

Global Demand: Rising Global Demand For Resources Can Push Up Commodity Prices.

Risks Of Investing In Commodities:

Volatility: Commodity Prices Can Be Highly Volatile Due To Factors Such As Weather, Geopolitical Events, And Changes In Supply And Demand.

Leverage Risk: Futures And Options Can Magnify Both Profits And Losses.

Market Risk: Commodity Markets Can Be Affected By A Variety Of External Factors, Making Them Unpredictable.

Investing In Commodities Can Be A Valuable Addition To A Diversified Portfolio, But It Requires An Understanding Of The Markets, Risks, And Available Investment Instruments.

Certificates Of Deposit (Cds)

A Certificate Of Deposit (Cd) Is A Financial Product Commonly Offered By Banks And Credit Unions. A Cd Is A Type Of Term Deposit Where You Agree To Deposit A Certain Amount Of Money For A Fixed Period Of Time In Exchange For Interest. Here Is A Detailed Description Of Cds As A Type Of Investment:

Key Features Of A Certificate Of Deposit:

Fixed Term:

Cds Have A Fixed Term Or Maturity Period, Which Can Range From A Few Months To Several Years. Common Terms Include 3 Months, 6 Months, 1 Year, 2 Years, 5 Years, Etc.

Fixed Interest Rate:

The Interest Rate On A Cd Is Usually Higher Than A Regular Savings Account, But Is Fixed For The Duration Of The Cd. This Means That The Interest Rate Remains The Same Despite Changes In Market Interest Rates.

Minimum Deposit Requirements:

Cds Often Require A Minimum Deposit Amount, Which Can Vary By Financial Institution And The Duration Of The Cd.

Penalty For Early Withdrawal:

Withdrawing Money From A Cd Before Its Maturity Usually Incurs A Penalty. The Penalty Amount Can Vary, But It Often Involves Forfeiting Some Or All Of The Interest Earned. Insured And Low Risk: Cds Are Usually Insured To Certain Limits By The Federal Deposit Insurance Corporation (Fdic) For Banks Or The National Credit Union Administration (Ncua) For Credit Unions, Making Them Low-Risk Investments.

Types Of Certificates Of Deposit:

Traditional Cd: This Is The Most Common Type Of Cd. You Deposit A Lump Sum For A Fixed Period Of Time And Earn A Fixed Interest Rate Until Maturity.

Jumbo Cd: Jumbo Cds Require A Larger Minimum Deposit, Usually $100,000 Or More, And Often Offer Higher Interest Rates Than Traditional Cds.

Bump-Up Cd: Bump-Up Cds Allow You To Request An Interest Rate Increase If The Bank’s Rates Rise During The Term Of Your Cd. This Usually Happens Only Once During The Term.

Step-Up Cds: Step-Up Cds Automatically Increase The Interest Rate At Specified Intervals. For Example, A 3-Year Step-Up Cd Might Increase The Rate Every Year.

Liquid Or No-Penalty Cds:

This Type Of Cd Allows You To Withdraw Money Before The Maturity Date Without A Penalty, Though It May Offer A Lower Interest Rate Than A Traditional Cd.

Zero-Coupon Cds:

Zero-Coupon Cds Are Sold At A Discount And Do Not Pay Periodic Interest. Instead, You Receive The Face Value At Maturity. The Difference Between The Purchase Price And The Face Value Is Your Interest.

Brokerage Cds:

These Cds Are Sold Through Brokerage Firms Rather Than Directly Through Banks. They May Offer Higher Yields, But May Also Come With More Risks And Complications, Such As Market Fluctuations Affecting The Cd’s Resale Value.

Benefits Of Investing In Cds:

Safety:

Cds Are Considered Very Safe Because Of Fdic Or Ncua Insurance, Making Them Suitable For Conservative Investors.

Predictable Returns:

Fixed Interest Rates Provide Predictable Returns, Making Financial Planning Easier.

No Market Fluctuations:

Unlike Stocks Or Bonds, Cds Are Not Subject To Market Fluctuations.

Drawbacks Of Investing In Cds:

Lower Returns:

Compared To Other Investments Such As Stocks Or Mutual Funds, Cds Generally Offer Lower Returns.

Liquidity Constraints:

Your Money Is Locked Up For The Term Of The Cd, And Early Withdrawals Typically Incur A Penalty.

Inflation Risk:

Fixed Interest Rates May Not Keep Pace With Inflation, Which Can Potentially Reduce The Purchasing Power Of Your Investment Over Time.

Savings Accounts

Savings Accounts Are A Common And Basic Type Of Investment, Offered Primarily By Banks And Credit Unions. They Are Designed For Individuals To Deposit Money And Earn Interest Over Time. Here’s An Overview Of How Savings Accounts Fit Into The Broader Landscape Of Investing:

Features Of Savings Accounts

Safety And Protection: Savings Accounts Are One Of The Safest Places To Keep Money Because They Are Typically Insured To A Certain Extent By Government Agencies (E.G., The Fdic In The United States). This Insurance Protects The Depositor’s Money Even If The Bank Fails.

Liquidity: Money In A Savings Account Is Easily Accessible. While There May Be Some Limits On The Number Of Withdrawals Or Transfers Per Month, You Can Generally Access Your Money Without Any Significant Delays.

Interest Rates: Interest Rates On Savings Accounts Are Typically Lower Than Other Investment Instruments Such As Stocks, Bonds, Or Mutual Funds. However, The Rate Is Guaranteed, Which Means You Earn A Steady, If Modest, Return On The Money You Deposit.

Minimal Risk: Since Savings Accounts Are Insured And Offer Guaranteed Interest Rates, They Come With Minimal Risk. They’re Ideal For Individuals Who Prioritize Capital Preservation Over High Returns.

Types Of Savings Accounts

Traditional Savings Accounts: These Are The Most Common Type, Offering Modest Interest Rates And Easy Access To Funds. They May Have A Minimum Balance Requirement And Limited Transaction Capabilities.

High-Yield Savings Account: Offered By Online Banks Or Financial Institutions, These Accounts Offer Higher Interest Rates Than Traditional Savings Accounts. They Typically Require A Higher Minimum Balance And May Have More Stringent Terms.

Money Market Account (Mma): Mmas Typically Offer Higher Interest Rates Than Traditional Savings Accounts And May Come With Check-Writing Privileges And Debit Card Access. They Often Require Higher Minimum Balances And Have Interest Rates Based On The Account Balance.

Certificates Of Deposit (Cds): Although Not Technically A Savings Account, Cds Are Time-Deposit Accounts That Offer Higher Interest Rates In Exchange For Locking Up Funds For A Specific Period. Early Withdrawals Usually Incur A Penalty.

Savings Accounts Vs. Other Investment Types

Stocks And Bonds: Stocks Have The Potential For Higher Returns But Also Carry More Risk Because Of Market Fluctuations. Bonds Are Less Risky Than Stocks But Generally Offer Lower Returns. Both Are More Complex And Less Liquid Than Savings Accounts.

Mutual Funds And Etfs: These Pooled Investment Vehicles Allow For Diversification And Professional Management. They Can Offer Higher Returns, But Come With Market Risk And Usually Higher Fees Than Savings Accounts.

Real Estate: Investing In Property Can Provide Significant Returns Through Appreciation And Rental Income. However, It Requires Substantial Capital, Involves More Risk, And Is Much Less Liquid Than A Savings Account.

When To Use Savings Accounts

Emergency Funds: Savings Accounts Are Ideal For Storing Emergency Funds Due To Their Liquidity And Safety.

Short-Term Goals: For Financial Goals Within A Short Time Frame (E.G., Vacation, Home Down Payment), Savings Accounts Provide A Safe Place To Grow Funds Without Exposure To Market Risk.

Cash Management: They Are Suitable For Managing Cash Flow And Ensuring You Have Accessible Funds For Daily Or Monthly Expenses.

Cryptocurrencies

Cryptocurrencies Have Emerged As A Popular Type Of Investment In Recent Years. Here Is An Overview Of Their Role In The Investment Landscape:

What Are Cryptocurrencies?

Cryptocurrencies Are Digital Or Virtual Currencies That Use Cryptography For Security. Unlike Traditional Currencies (Fiat Currencies) That Are Issued By Governments, Cryptocurrencies Operate On Decentralized Networks Based On Blockchain Technology.

Types Of Cryptocurrencies

Bitcoin (Btc): The First And Most Well-Known Cryptocurrency, Often Considered Digital Gold.

Ethereum (Eth): Known For Its Smart Contract Functionality, Enabling Decentralized Applications (Dapps).

Altcoin: Any Cryptocurrency Other Than Bitcoin, Such As Litecoin, Ripple (Xrp), And Cardano (Ada).

Stablecoin: Cryptocurrencies Pegged To A Stable Asset Such As The Us Dollar To Minimize Price Volatility (E.G., Tether (Usdt), Usd Coin (Usdc)).

Cryptocurrencies As Investments

Cryptocurrencies Can Be Considered In Different Investment Categories:

Speculative Investments

High Volatility: Prices Can Fluctuate Dramatically In The Short Term, Leading To High Potential Returns But Also Significant Risks.

Market Sentiment Driven: Prices Are Often Influenced By News, Market Sentiment, And Social Media Trends.

Long-Term Investing (Hodling)

Digital Gold: Some Investors View Bitcoin As A Store Of Value Similar To Gold.

Technological Belief: Belief In The Long-Term Potential Of Blockchain Technology And Decentralized Finance (Defi) Systems.

Diversification Tools

Portfolio Diversification: Cryptocurrencies Can Be Added To A Diversified Investment Portfolio To Potentially Improve Returns And Manage Risk.

Income Generation

Staking: Some Cryptocurrencies Offer Staking Rewards, Where Investors Earn More Coins By Participating In Network Security.

Yield Farming And Lending: In Defi, Investors Can Lend Their Cryptocurrencies Or Participate In Liquidity Pools To Earn Interest.

Risks And Considerations

Regulatory Risk: Governments May Impose Regulations Affecting The Legality And Taxation Of Cryptocurrencies.

Security Risk: The Digital Nature Makes Them Susceptible To Hacking And Fraud.

Market Risk: Extreme Volatility Can Lead To Significant Financial Losses.

Technical Risk: Bugs, Failures Or Changes To Blockchain Protocols Can Impact Investments.

Options And Derivatives

Options And Derivatives” Are Types Of Financial Instruments Used In Investing.

Options: Options Give The Buyer The Right, But Not The Obligation, To Buy Or Sell An Asset (Such As Stocks, Commodities Or Currencies) At A Predetermined Price Within A Certain Time Frame. There Are Two Main Types:

Call Option: Allows The Holder To Buy An Asset At A Certain Price (Strike Price) Before A Certain Date.

Put Option: Allows The Holder To Sell An Asset At A Certain Price (Strike Price) Before A Certain Date.

Derivatives: Derivatives Derive Their Value From The Underlying Asset, Index Or Interest Rate. They Are Used For Hedging (Risk Management) Or Speculation. Common Types Include:

Futures: Contracts Obligating The Buyer To Buy (Or The Seller To Sell) An Asset At A Certain Future Date And Price.

Swaps: Agreements Where Two Parties Exchange Cash Flows Or Other Financial Instruments.

Forwards: Similar To Futures But Over-The-Counter (Otc) And Customized For Specific Conditions. These Instruments Are Traded In The Financial Markets And Can Be Complex, Requiring An Understanding Of Market Dynamics, Risk Management, And The Potential For Substantial Profits Or Losses

Private Equity

Private Equity Refers To Investments Made In Privately Owned Companies That Are Not Listed On Public Exchanges. It Involves Investing Directly In Or Acquiring Companies, Often With The Goal Of Restructuring Or Improving Operations To Increase Their Value.

Types Of Investments In Private Equity:

Buyout: This Involves Acquiring A Controlling Stake In A Company, Often Using A Combination Of Debt And Equity. The Aim Is To Restructure The Company And Eventually Sell It For A Profit.

Venture Capital: Investments In Early-Stage Or Startup Companies That Have High Growth Potential. Venture Capitalists Provide Funding And Expertise To Help These Companies Grow Rapidly.

Mezzanine Capital: This Type Of Investment Combines Elements Of Debt And Equity. It Usually Takes The Form Of Subordinated Debt Or Preferred Equity And Is Used To Finance Acquisitions, Expansions, Or Buyouts.

Distressed Investing: Investing In Companies That Are Experiencing Financial Difficulties Or Are Going Through Bankruptcy Reorganization. The Purpose Of These Investments Is To Replace A Company’s Operations Or Assets.

Secondary Market Investing: Buying And Selling Existing Private Equity Investments, Often From Other Investors. This Allows Investors To Enter Or Exit The Investment Before The Company Is Sold Or Goes Public.

Each Type Of Private Equity Investment Carries Varying Levels Of Risk And Potential Returns, Depending On Factors Such As The Stage Of The Company, Industry Dynamics, And Market Conditions.

Venture Capital

Venture Capital Is A Type Of Investment In Which Investors Provide Funding To Startup Companies And Small Businesses That Are Believed To Have Long-Term Growth Potential. Here Are Some Key Aspects Of Venture Capital Investing:

Risk And Return: Venture Capital Investments Are Considered High Risk, High Return. Investors Accept A Higher Risk Of Failure In Exchange For The Potential For Significant Returns If The Startup Succeeds And Grows Sufficiently.

Equity Investment: Instead Of Providing A Loan, Venture Capitalists Typically Invest In Exchange For Equity (Ownership) In The Company. This Means They Become Shareholders And Have A Stake In The Company’s Future Profits And Growth.

Startup Stage: Venture Capital Is Often Provided To Startups Or Early-Stage Companies That Have Innovative Ideas Or Products But May Not Yet Be Profitable Or Have A Proven Business Model.

Value-Added Support: Beyond The Financial Investment, Venture Capitalists Often Provide Strategic Guidance, Advice, And Industry Connections To Help Startups Grow And Succeed.

Exit Strategy: Venture Capitalists Hope To Receive Their Returns Through An Exit Event, Such As The Company Going Public (Ipo) Or Being Acquired By Another Company. This Is The Time When They Can Sell Their Equity For A Profit.

Overall, Venture Capital Plays A Vital Role In Fostering Innovation And Entrepreneurship By Providing Funding And Support To Promising Startups That May Have Difficulty Obtaining Financing Through Traditional Means Such As Bank Loans.

Hedge Funds

“Hedge Funds” Refer To Investment Funds That Pool Money From Investors And Invest It In Various Financial Instruments With The Goal Of Generating A Return. These Funds Typically Use A Variety Of Strategies That Can Include Both Traditional And Alternative Approaches To Investing. The Term “Hedge” Was Originally Used To Mean Reducing The Risk Of An Investment Using A Variety Of Techniques, Although Today Hedge Funds May Not Always “Hedge” In The Traditional Sense.

Here Are Some Key Points About Hedge Funds In Terms Of Types Of Investments:

Investment Strategies: Hedge Funds Can Pursue A Variety Of Investment Strategies, Such As Long/Short Equity, Global Macro, Event-Driven And Quantitative Strategies. These Strategies Vary In Terms Of Risk And Return Potential.

Alternative Investments: They Often Invest In Alternative Asset Classes Beyond Stocks And Bonds, Such As Derivatives, Commodities, Currencies And Even Real Estate.

Leverage And Derivatives: Hedge Funds Use Leverage (Borrowed Money) And Derivatives (Financial Instruments) To Enhance Returns Or Manage Risk. Contracts Whose Value Is Derived From An Underlying Asset).

Regulation And Access: They Are Generally Less Regulated Than Mutual Funds And Are Often Restricted To Accredited Investors Because Of Their Sophisticated Strategies And Potential Risks.

Performance And Fees: Hedge Funds Often Charge Higher Fees Than Traditional Mutual Funds, Typically A Management Fee (A Percentage Of Assets Under Management) And A Performance Fee (A Percentage Of Profits).

Overall, Hedge Funds Hold A Unique Position In The Investment World, Attracting Investors Seeking Potentially Higher Returns And Willing To Take On More Risk In Exchange For Potentially Higher Rewards.

Annuities

Annuities Are A Type Of Investment Product In Which The Individual Typically Pays A Lump Sum Or A Series Of Payments To An Insurance Company Or Another Financial Institution. In Return, The Institution Provides The Individual With Regular Payments Over A Specified Period Of Time, Often For The Rest Of Their Life Or For A Set Number Of Years. Annuities Are Commonly Used For Retirement Planning Because They Can Provide A Steady Income Stream.

There Are Several Types Of Annuities:

Fixed Annuities: These Provide A Guaranteed Fixed Payment Amount Over The Lifetime Of The Annuitant, Providing Stability But Usually With Lower Potential Returns Than Other Types.

Variable Annuities: These Allow The Investor To Choose From A Selection Of Investments (Such As Mutual Funds) Within The Annuity. Returns Can Vary Depending On The Performance Of These Investments, Offering The Potential For Higher Returns But Also More Risk.

Indexed Annuities: These Combine Features Of Both Fixed And Variable Annuities. Returns Are Linked To A Specific Index (Such As The S&P 500), Providing The Potential For Higher Returns Than Fixed Annuities, But With Some Protection Against Market Downturns.

Annuities Can Be Structured In Different Ways, Such As Immediate (Where Payments Begin Immediately) Or Deferred (Where Payments Begin At A Later Date). They Are Often Used To Provide Retirement Income Or Ensure Steady Cash Flow Over A Specific Period Of Time

Conclusion

Each Type Of Investment Has Its Own Risk And Return Profile. Diversifying Your Investment Portfolio Across Different Asset Classes Can Help Manage Risk And Achieve A Balanced Approach To Investing. Always Consider Your Financial Goals, Risk Tolerance And Time Horizon When Choosing Investments